A few weeks ago the Swedish mobility agency in a public announcement told EV drivers that it would be wise if they walked or biked for shorter distances, rather than use their shiny new EV. That’s of course the car they’ve been more or less coerced into buying and replace their old combustion one with, and it’s at the time of year when in Sweden, neither a walk or a bike run is necessarily what you’re dreaming of. This is only one of many small outcomes of the energy crisis Europe is currently battling, or put differently, the crisis where European tax payers pick up the bill for decades of political energy policy mismanagement. This week’s post will be more about what goes into the tank than the car itself – but as we all know, no fuel no fun… Regular programming will resume next week.

Russia’s barbaric onslaught on Ukraine which will hopefully by some divine justice have Putin and his closest gangsters burn in a warm place for very long, is a complete tragedy. We may complain about energy security and fuel prices, but let’s never forget that the Ukrainians are paying a far heavier price, currently without an end in sight. The Ukraine war has however also provided populist politicians the opportunity to put the blame for their own failures on the war and Putin. EU representatives in Brussels like to talk about how Putin has weaponized energy. The exiting Swedish PM speaks about “Putin prices” when defending any kind of spiraling energy prices, notably at the petrol station, although half the price is tax. And so on. Clearly the war has had devastating effects on Europe’s energy supply, but it’s only had so because of Europe’s careless and self-imposed reliance on Russian energy.

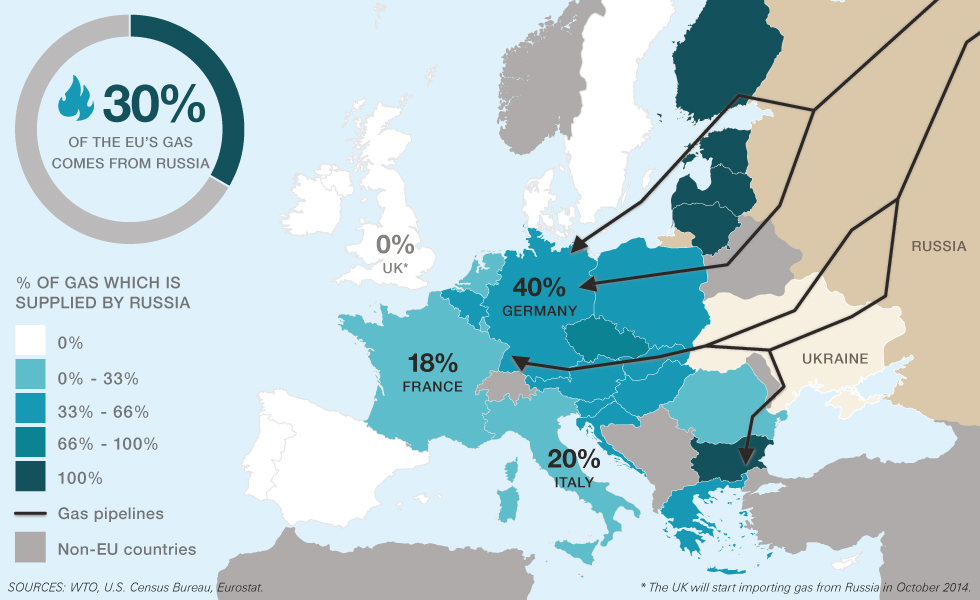

Going into the war, 40% of Germany’s natural gas came from Russia. Gas makes up around 25% of Germany’s total energy mix but far more in the all-important industrial mix, so putting it bluntly, Europe’s largest economy put the energy supply of its industry and thereby the security of the whole country in the hands of Putin the dictator. And by the time the now blown-up NordStream II pipeline was built in the second half of the 2010’s, Putin had already showed what he was made of by invading not only Crimea in 2014, but before that also by engaging in wars with Georgia and in Chechnya – twice. So it was, or at least should have been, in complete knowledge of the facts that then German chancellor Merkel took the decision to hand the keys to the German industrial kingdom to Vladimir Putin, with many other European countries doing more or less the same. You really can’t make it up.

To get to the root of the problem we do however need to go back to 2011 when immediately following the tsunami-caused Fukushima disaster, Merkel decided to close down Germany’s nuclear plants. Fukushima is of course on the other side of the world seen from Germany and the accident had no relevance whatsoever to Germany’s nuclear security, given the only coast Germany has is to the North Sea which isn’t very prone to tsunamis, and in addition not where Germany’s nuclear plants are located. But hey, who cares about energy security when there is a chance to earn political points with the growing Green movement? Here in Switzerland our local politicians jumped on the train before it had even stopped at the station and decided to close down our local plants. Of course we continue to import nuclear power from neighboring France and could never have closed down our own plants without those imports, but that’s something we don’t really like to talk about.

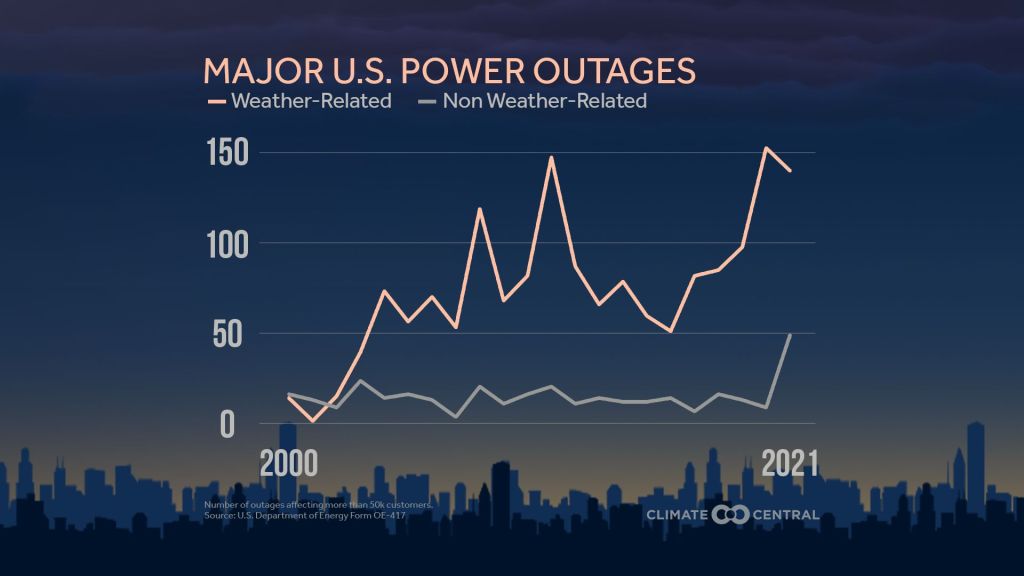

Nuclear is also where Europe and the US meet in our respective crises, with US policy in the last decade being just as set on closing down nuclear as Europe. The problem is of course that in parallel both sides of the pond also wanted to close down fossil fuels, in other words leaving us with no weather independent source of base power. In the US this has translated to more black-outs last year than at any point in history, and fuel prices in California are now getting close to USD 7 per gallon, which still sounds like a steal seen from Europe but is a historical high from a US perspective. President Biden has consistently acted against any expanded production of both oil and natural gas, at the same time as depleting the strategic oil reserve and traveling to Saudi Arabia, trying to get the true democrats down there to increase production. In essence, the message to US oil companies is “guys, we really don’t like you and we’ll close down all your business in a few years, but until then, could you please invest a few billion and increase production?”.

Enough of the ranting, but the above needs to be said to put the current situation into context. For some strange reason though it usually isn’t, and I’m pretty convinced things will not get better unless those responsible are willing to stand up for mistakes made in past. Whether in the US or in Europe, we’re not in an energy crisis primarily because of Putin’s war in Ukraine or because the Saudis won’t increase production – we’re here because of naive, uninformed and populistic political policies that we as taxpayers are now paying for at the pump, by not using the EV that it was so important we buy, or by freezing in our homes.

The bad news is of course that this will not end anytime soon, but it’s at least good to see that a bit like a drunk waking up on the side of the road, European countries including Germany are now really scrambling for solutions and doing all they can to remedy the situation. Notably in terms of gas supply things are changing quickly, with a heavily reduced dependance on Russia that will go towards nil in 2023. That’s all great, but it only solves part of the problem. Through policies like the ones described above, most countries at present quite simply don’t have any reserve capacity for any type of energy. Building nuclear isn’t done in a couple of months, neither are necessary LNG terminals or for that matter little-discussed but very essential grid investments for renewables that are desperately lacking across Europe, and for which there risks not being any money left in the new recessionary environment we find ourselves in, coupled with increased defense budgets.

What happens now is therefore a return to the old power sources we thought were closed down forever. Coal imports to Europe have increased by more than 30% in 2022 compared to previous years. In Poland natural forests are now being chopped for energy and people are burning garbage. In Sweden, the oil-fired power plants are back in action and in Denmark, neighbors steal each others’ wood pellets. Climate policy is out the window and we’d better all wish for a very sunny, windy and mild winter across both Europe and the US, which is not really what winter typically looks like. Otherwise, more or less power cuts could be on many countries’ agendas for the coming months. And even in the US, we can safely assume that oil production will increase when people really start freezing.

If electricity really is rationed, you can be pretty sure that EV charging will not go unaffected. The Swedish mobility agency may have been first, but a similar message will no doubt go out in other countries as well. EV charging will also continue to increase in price. How much depends on where you live and where you charge, but as a scary example there are charging stations in the UK where a 300 km charge now costs around £50, which is more expensive than fuel would be for a mid-sized car. And that’s assuming you find a station that works, which seems to be quite rare over there… If you need your car for your daily life and if you’re dependent on the public grid for charging, buying an EV right now is probably not the best idea.

Defeating Putin in Ukraine is of course more important than prices at the pump and would most probably help reduce the price of oil and gas, and thereby inflation. It’s interesting how politicians of all colors are now changing their tune with regards to nuclear and have a very hard time remembering where they stood on the issue until very recently. I had to rub my eyes hard this week when the climate activist Greta Thunberg joined the crowd, talking about Germany’s mistake in closing down its nuclear plants. Of course Greta as recently as 2019 was publicly against nuclear. The more things change they also stay the same though, because only two days later, ex-chancellor Merkel in only the second big interview since she left office said she doesn’t regret anything.

This may all be entertaining but it’s against a serious background where until there is at least more clarity on how our power supply and energy mix will look going forward, the safest option is no doubt to keep your combustion car, because whatever you pay at the pump, it’s still cheaper than buying an EV (and charging it). As we’ve looked at previously you won’t save the climate anyway by driving electric, and you may indeed want to decide yourself when to drive your car and when to bike or take a walk.