Between US elections, the wars in Ukraine and the Middle-East, and whatever else may have passed through your news flow this summer, chances are that you’ve missed something that’s gone a bit under the radar. And that, my friends, is more or less a complete turnaround in the business plans of the world’s leading car manufacturers, and the roaring comeback of the good old combustion engine!

The ICE is making a comeback at a level that no one would have expected just a couple of months ago. Doing so, it proves a few points that won’t be new to readers of this blog, but that I’m happy to note anyway, since it’s always nice to be right: firstly, if you want to sell stuff, there needs to be demand. Secondly, if something cannot hold in the long term, it will break sooner or later. And thirdly, it’s unwise to bet against the world’s largest car company, especially when it’s Japanese. Let’s dig in and look at what you may have missed while sipping your pina colada at the beach!

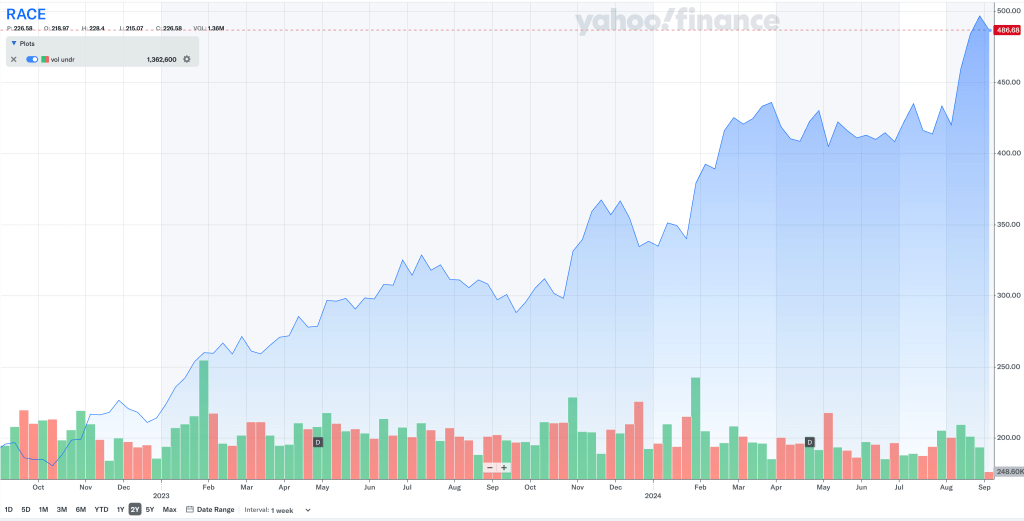

To set the scene, let’s start with something that EVO, the UK car magazine that this blog takes its inspiration from, noted in its editorial back in July, namely that within just the last month, three new combustion engines involving five global car brands were announced. In all cases, it was about ICE’s optimized for hybrid usage with electrical motors, efficiency measures, adaptations to sustainable fuels etc. Other signs that the combustion engine is far from dead have also flourished over the last year, perhaps nowhere more so than in Modena with the Purosangue’s naturally aspirated V12. The fact that Ferrari shares are among the best investments you could have done over the last years also don’t really speak in the direction of a quick demise of the ICE.

It’s also interesting how differently car CEO’s speak today, compared to just a few months back. The first one that made me swallow my coffee the wrong way was Peugeot CEO Carlos Tavares, who during a car show went on camera, stating in the blunt way only a Frenchman can that electrification is nothing car manufacturers have chosen – it’s something Brussels (meaning the EU) has imposed. His body language made clear he enjoyed it about as much as a rotten slice of foie gras. Unfortunately, Stellantis (the group Peugeot belongs to) have replaced him since the interview.

A few weeks later it was Ola Källenius, the Swedish CEO of Mercedes-Benz, who until recently was very happy to tell everyone about Mercedes’s fully electrical future but now sings a different tune, whereby combustion cars are still very much part of the Mercedes mix, alongside hybrids and EV’s. That’s of course a direct consequence of the lukewarm reception Mercedes EV’s have gotten from the market, especially the soap-like EQS. Now the talk is of a new S- and even E-class coming with as options combustion, hybrid and electrical engines.

A few months earlier the same message had come from BMW in Munich, confirming several combustion engine initiatives over the coming years. To round it off, in the same week as this is published, Volvo joined the long list of manufacturers stepping away from an all-electrical future, in Volvo’s case by 2030. The talk is now of reaching 90%, however including various types of hybrids.

None of this is really surprising. Because what all these car CEO’s seem to have forgotten, but actually should know better than various politicians and other policy makers, are the laws of supply and demand. And what has become painfully clear is that there is no demand for EV’s on the scale the political class would like there to be (if you need to read up on why they won’t do anything for the climate and are currently one of the most unethical industries around, see here, here, and here). From a European perspective it’s actually even worse, since the day, should it come, when demand improves, it’s not European, but rather Chinese manufacturers who stand to profit from it.

Let me give you a couple of pretty staggering examples of this in real life. The Porsche Taycan is generally hailed as the best EV around from both a driving and a charging perspective (if not range). Two years old and with less than 30.000 km’s on the meter, it can easily be had for 30-40% of the price as new – that’s a depreciation of over 50% in less than two years for the best car in the segment! And with the new model out, those numbers will certainly not improve going forward.

A Polestar 2, a European EV favourite, far less good than a Taycan but also far cheaper at around 75-80′ as new, will without problems be yours for 30-35′ with the same kind of mileage as the Taycan. And should you like soap, the numbers for the Mercedes-Benz EQS are similar. It’s getting to a point where European car dealers no longer want to trade in EV’s, not just because of the insecure value, but also since they tend to sit in the courtyard far longer than traditional cars.

What’s happening is that disappointed owners, either outright or through various types of leases which typically have a 36-month life (at least in Europe), trade in their EV’s and when doing so, opt for a conventional car to replace it with. That’s the case in up to 90% of cases in the US, as various reports have shown. Why? Well, unrealistic range promises, especially in winter, a lacking charging infrastructure, and various technical and quality issues with many EV’s all make for a not very attractive cocktail. As energy prices rose in parallel to the ownership and will continue to do so for every windmill and solar farm that is set to replace conventional energy, it turns out the savings over a traditional car aren’t that big.

The combustion engine technology is now over 150 years old, removing the technology risk that is very much present in the EV market, and that all the talk of battery revolutions only contribute to. Two years ago it was just a matter of time before solid state batteries once and for all solved the range and charging issues. Now, it’s instead sodium batteries that will do the same, and are simpler to develop. Who in their right mind would buy an EV, more expensive than a traditional car, with a technology that risks being obsolete in a year? You take this together with all the other EV issues you know well by now, and the logical conclusion is that other than in cities or for shorter trips, the ICE still reigns supreme.

As this sinks in, the effect is that conventional manufacturers go back to what they’re good at, i.e. technological innovation around the combustion engine, and EV manufacturers that are not very well capitalized start going belly up. Fisker already did (making it the second time the Dane Henrik Fisker manages to bankrupt the same brand), others are heavily at risk (Polestar starts having pretty severe cash issues and a share price that is at rock bottom) or not in control of their destiny (Lucid who are at the mercy of the Saudi money tap). All this is normal – every new industry has a lot of companies who don’t make it. It was just the buzz of the last years that may have made it look different.

What is not normal is however the elephant in the room called China, that as said previously, I believe will dominate the low- to mid-priced EV market going forward. Why? Well, with a home market of over a billion people, unlimited state subsidies and a supply chain of rare metals especially from Africa that has been carefully crafted over the last decade, China has done everything Europe should have done to be successful, had they really meant business. Instead, the EU now wants to put tariffs on Chinese EV’s, which less than a month after it was announced, was countered by China doing a deal with Saudi Arabia, where Chinese EV’s for Europe will be produced with no tariffs. And there won’t be any sanctions or tariffs on Saudi going forward either, that oil they also sell, is very helpful when it gets cold.

Going forward, the world will thus hardly be fully electric, and this is where the world’s largest brand Toyota comes in. Although they were heavily criticized by the environmentalist lobby, the Japanese stuck to their guns and continued to produce and perfect hybrid solutions. Their logic is simple and should have been easy enough for every car company to understand: if the supply of rare metals and other input materials is limited, then splitting a large battery pack into four smaller packs for four cars, rather than a big one for one, makes a lot of sense. Hybrids also eliminate all the issues linked to range, charging, and under-capitalized car brands no one has heard of.

So where does all this leave us? Well, conventional manufacturers will be all too happy to reverse course and fall back on what will be the conventional car market going forward – meaning hybrid solutions around the combustion engine. And should there be an evolution around e-fuels, we can probably do without the whole hybrid package as well. On the other side, there will be EV’s at various price points, working well for cities, shorter trips or people preferring the technology. And yes, should we in the end get a battery revolution in terms of range, charging and more sustainable input materials, maybe they will take over -but that’s neither for tomorrow, nor next year.

It’s pretty incredible that it’s taken us this long to get us to the only place that made sense from the beginning, but as said initially, if something cannot hold, it will break sooner or later, and the dreams of 100% EV’s just did. Personally, i’d be delighted to consider a hybrid. I’d have nothing against driving fully electric on shorter distances, and reducing my fuel consumption on longer trips. The ethical issues linked to rare metal excavation are still not solved, but I guess you can’t have everything, and things are at least improving in this regard. Mark Twain once replied to a letter by saying that “the report of my death was an exaggeration”. Mid-2024, the same thing is just as true for the combustion engine!